Find out the eligibility, qualifying expenses, credit percentage and limits, and how to file form 5695. The single biggest solar incentive in florida is actually a federal tax credit. Find out the eligibility criteria, how to apply and compare solar panel installers.

Solar incentives What you need to know Wolf Track Energy

Learn how the inflation reduction act expanded the federal tax credit for solar photovoltaics, increasing it from 22% to 30% for systems installed in 2022.

Find out the eligibility requirements and how to claim the credit on your taxes.

Learn about the federal solar investment tax credit (itc) for homeowners, businesses, and manufacturers from the u.s. Find out how the itc changed in 2022 and how to claim it. Learn how to claim a tax credit for residential solar pv systems installed between 2006 and 2023. Find out the eligibility criteria, eligible expenses, and how other incentives affect the credit.

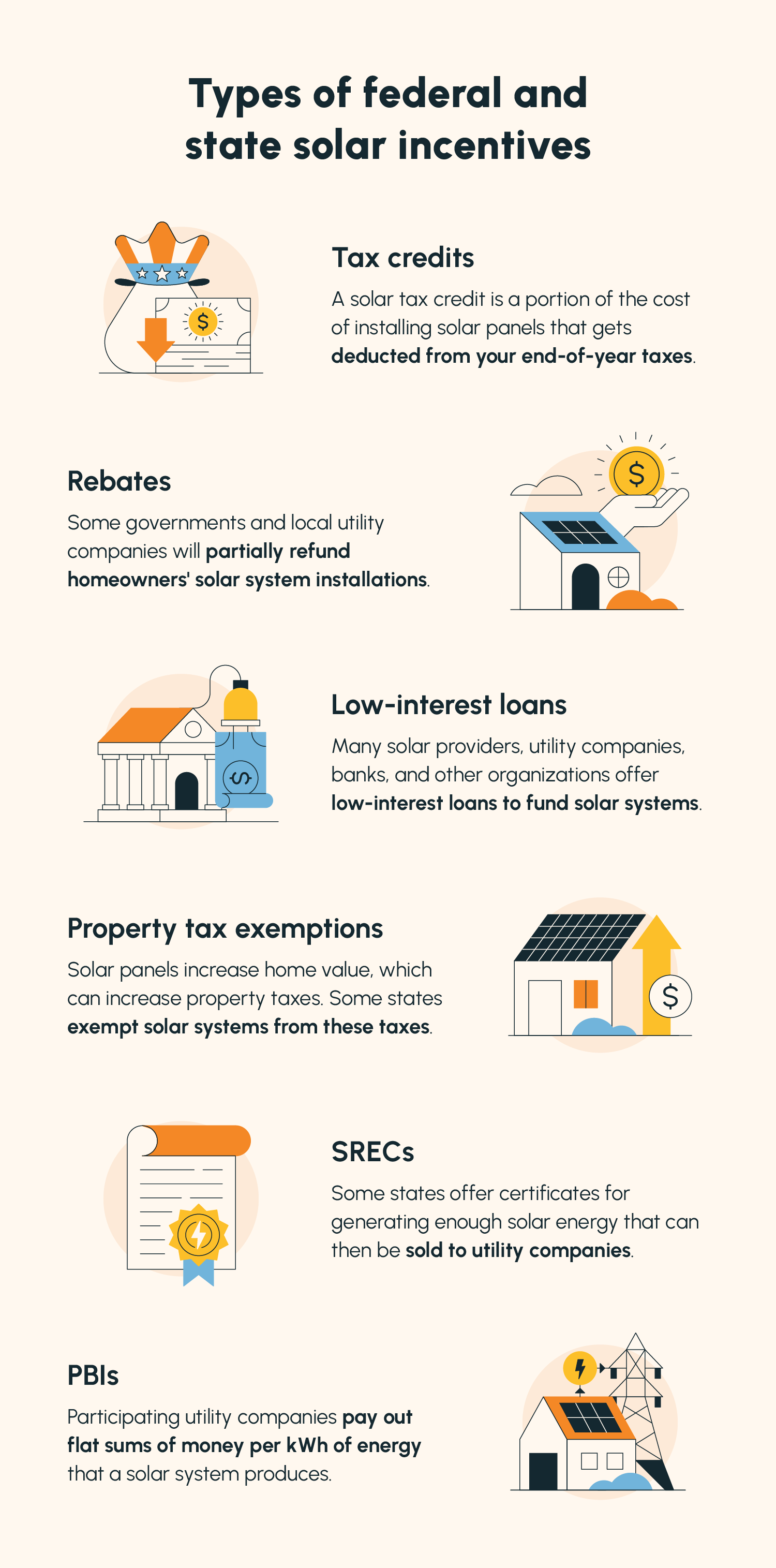

Learn about the federal and state solar tax credits, rebates, and performance payments that can help you reduce the cost of going solar. Find out the average savings and eligibility criteria for each incentive program in this comprehensive guide. Find out how to save money on solar panel installation with tax credits, rebates, grants and other incentives in 2025. Compare solar incentives by state and learn about the federal solar investment tax credit.

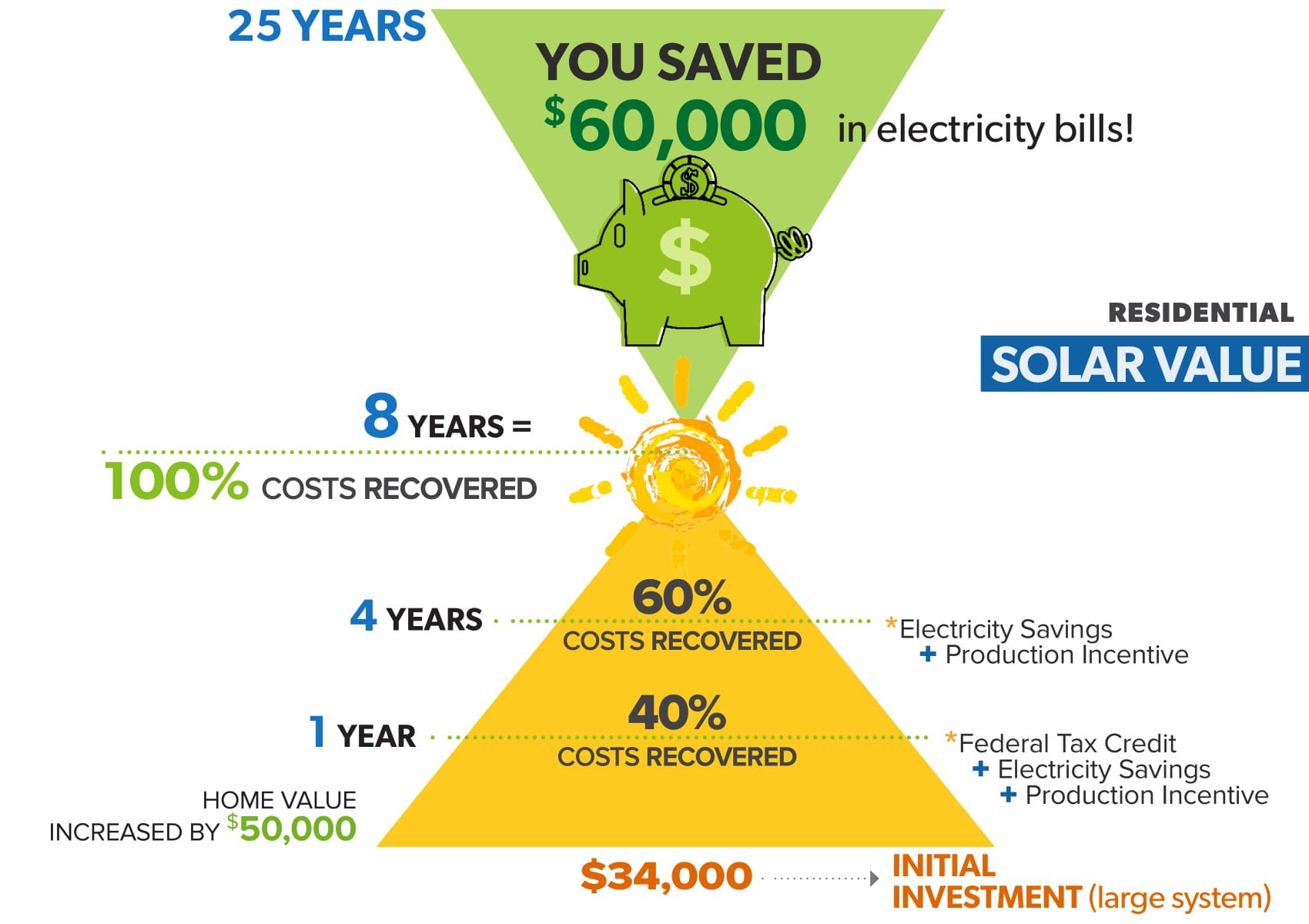

Also known as the investment tax credit (itc), this solar incentive was at 26% in 2022 and scheduled to step down to 22% in 2023 before going away entirely for residential solar in 2024.

However, with the ira in effect, the tax credit is back to 30% until 2032… or until a future administration repeals it. A solar panel government subsidy is like a financial boost from the government to help you afford solar panels. These subsidies, which may include tax credits, rebates, or grants, aim to make renewable energy more accessible to homeowners and businesses. The executive order stipulates a pause in the distribution of funding for the ira, which includes federal incentives for solar.

However, it’s unclear what, if any, solar incentives will be impacted as of now. In the executive order, “ declaring a national energy emergency,” solar wasn’t defined as an energy resource. However, you may also have access to additional solar incentives from your state, municipality or utility that can reduce the cost of going solar even further. And every penny reduced from your solar cost is a penny saved in energy costs.

Below is a list local solar incentives broken into states.

This resource is a work in progress. The residential clean energy credit, runs through 2034 and offers a tax credit valued at 30 percent of the total cost of a solar system. Tax credits, net metering and tax exemptions are three of the most valuable solar incentives offered on a state or local basis. These incentives can be used in tandem with the 30% federal solar

This includes 1 rebate and 1 financing program. Some states offer solar tax credits that can be claimed in addition to the 30% federal solar tax credit. New york state has a 25% solar tax credit with a maximum value of $5,000; Hawaii has a 35% state solar tax credit with a maximum value of $5,000

Tax credits allow you to reduce your state or federal tax burden based on the total cost of your solar system.

The most important incentive for installing residential solar is the federal tax credit for solar photovoltaics, which has its origins in the first residential energy credit Incentives such as fit, portfolio standards, tax exemptions, production and r&d incentives, solar projects, etc. Each country has implemented these production incentives at different targets and in different ways, according to their pv potential, economic situation, and environmental society concerns. Incentives nationwide are offering up to thousands to homeowners with solar, ev charging and battery storage.

Which programs are available for you? Solar on multifamily affordable homes (somah) program solar incentives. For income qualified households in disadvantaged communities only: Disadvantaged community single family solar homes (dac sash) program solar incentives.

Lsee what solar incentives your state offers for residential solar.

Search solar incentives by state to see your specific state's solar incentives. The federal solar tax credit is an investment tax credit (itc). That basically means it’s an incentive meant to spur investment in something the government wants to support. Compare the best tax software of 2025

The green energy program began in 1999. It has provided funding to more than 6,000 delaware renewable energy projects. Rebates maintained by the dnrec division of climate, coastal and energy are available to offset the installed cost of renewable energy technologies, including photovoltaic (solar), geothermal, solar water heating and wind.