Hey there! Let’s talk about something that matters to just about everyone this time of year—your tax refund. Whether you're eagerly waiting for your money or just curious about what's going on with it, we’ve got you covered. Here’s everything you need to know about checking your refund status and staying on top of things.

How to Check Your Refund Status

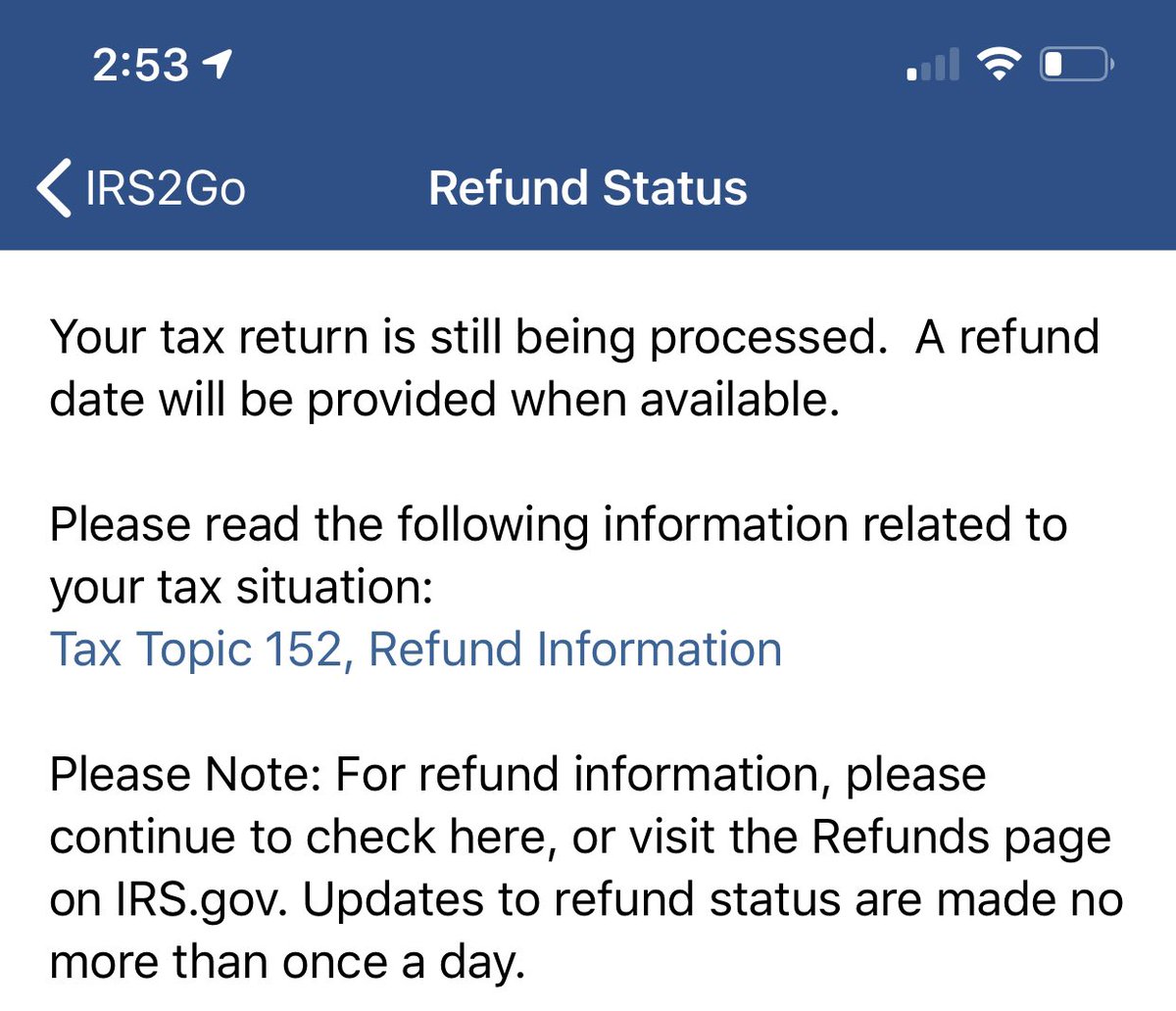

Let me break it down for you. You can easily check your refund status online or through the IRS2Go app. All you need is your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact refund amount from your tax return. Once you have those details handy, you're good to go. Just plug them into the system, and voilà—you’ll get the latest update on your refund.

Why Security Matters

Now, before you start worrying about your information being safe, don’t. This system is secure and monitored by the IRS to protect you. So, when you enter your SSN, tax year, filing status, and refund amount, rest assured your data is handled with care. The IRS takes your privacy seriously, and so should you. Always double-check the website or app you're using to ensure it’s legit.

Read also:Nvidia Stock The Ultimate Guide For Investors And Tech Enthusiasts

Understanding the Three Stages of Your Refund

Here’s the deal: The IRS tracks your federal income tax refund through three stages—Return Received, Refund Approved, and Refund Sent. Each stage is important, and knowing where your refund stands can help you plan accordingly. The tool even gives you a personalized refund date once the IRS processes your return and approves the refund. It’s like having a little progress bar for your money!

Check Your Refund Status in English or Spanish

Did you know you can check your refund status in both English and Spanish? That’s right. Whether you prefer one language over the other, the IRS has got you covered. You can either use the online tool or call the IRS’s refund hotline for assistance. It’s all about making the process as smooth and accessible as possible for everyone.

What If You Don’t See Your Refund?

Sometimes, things don’t go as planned. If you don’t see your refund status after waiting the usual time, don’t panic. There could be several reasons, such as a delay in processing or an issue with your return. The IRS issues most refunds within 21 calendar days, but if yours is taking longer, you might want to investigate further. Use the “Where’s My Refund?” tool or give the IRS a call for more details.

Amended Returns and Special Cases

What if you filed an amended return? Well, there’s a tool for that too. Use the “Where’s My Amended Return?” tool to check the status of your amended return. It’s a bit different from the regular refund tracker, so make sure you’re using the right one. And remember, if you filed a paper return for a current year homestead credit refund, your information won’t be available until July. So, patience is key in this case.

Stay Informed with Regular Updates

The IRS is always working to improve the “Where’s My Refund?” tool. Recent updates mean fewer taxpayers will need to call the IRS for help, which is great news for everyone. The tool now provides more detailed information and keeps you updated throughout the refund process. It’s like having a personal assistant for your taxes!

How to Use the Tool Effectively

Here’s a quick guide on how to use the tool effectively:

Read also:Yuji And Nobara The Dynamic Duo Of Jujutsu Kaisen

First, make sure you have all the necessary information: your SSN or ITIN, your filing status, and the refund amount as shown on your tax return. All fields marked with an asterisk (*) are required, so don’t skip any steps. Once you’ve entered everything, you’ll get a personalized refund date. It’s that simple.

Common Delays and What to Do

Let’s face it—delays happen. If your refund is taking longer than expected, there could be several reasons. Maybe there was a mistake on your return, or perhaps the IRS needs more information. Whatever the case, stay calm and check the tool regularly for updates. If you’re still unsure, calling the IRS might be your best bet.

Final Thoughts

Checking your tax refund status doesn’t have to be a headache. With the right tools and a bit of patience, you can stay informed every step of the way. Remember, the IRS is there to help you, and so are the many resources available online. So, take a deep breath, gather your info, and start tracking your refund today. You’ve earned it!

Meta Description: Need to track your IRS tax refund? Learn how to check your refund status online or by phone with easy-to-use tools. Get updates on your return and find out when your refund is coming your way.

Title: Track Your IRS Tax Refund Status Online or by Phone | Easy Steps