Let’s cut to the chase, shall we? The S&P 500 is more than just a stock market index—it’s the pulse of the global economy, a barometer of corporate health, and a cornerstone for investors worldwide. If you’ve ever wondered why everyone talks about the S&P 500 or why it matters so much, this article is your ticket to understanding its significance. Whether you're a seasoned investor or someone just dipping their toes into the world of finance, the S&P 500 is something you need to know about. And trust me, it’s not as complicated as it sounds.

Think of the S&P 500 as the A-list of publicly traded companies in the United States. It’s like an exclusive club where only the biggest and best companies get in. But it’s not just about being big; it’s about being influential. The S&P 500 includes companies across various sectors, from tech giants to consumer goods, ensuring it gives a well-rounded picture of how the U.S. economy is doing. It's like a snapshot of the American dream in numbers.

Now, before we dive deeper into the nitty-gritty, let’s clear the air. The S&P 500 isn’t just for Wall Street elites. It’s for anyone who wants to understand what’s happening in the world of finance. Whether you're saving for retirement, planning your next investment move, or simply curious about how markets work, the S&P 500 is your go-to index. So, buckle up because we're about to break it down in a way that’s as easy as ordering pizza online.

Read also:Aldi Product Recall What You Need To Know Right Now

What Exactly Is the S&P 500?

Alright, let’s get into the meat of things. The S&P 500, short for Standard & Poor's 500, is a stock market index that tracks the performance of 500 large-cap U.S. companies. These companies are selected based on their market size, liquidity, and sector representation. It’s not just any random list of companies; it’s carefully curated to reflect the overall health of the U.S. economy. Think of it as the Dow Jones Industrial Average's cooler cousin—more inclusive and broader in scope.

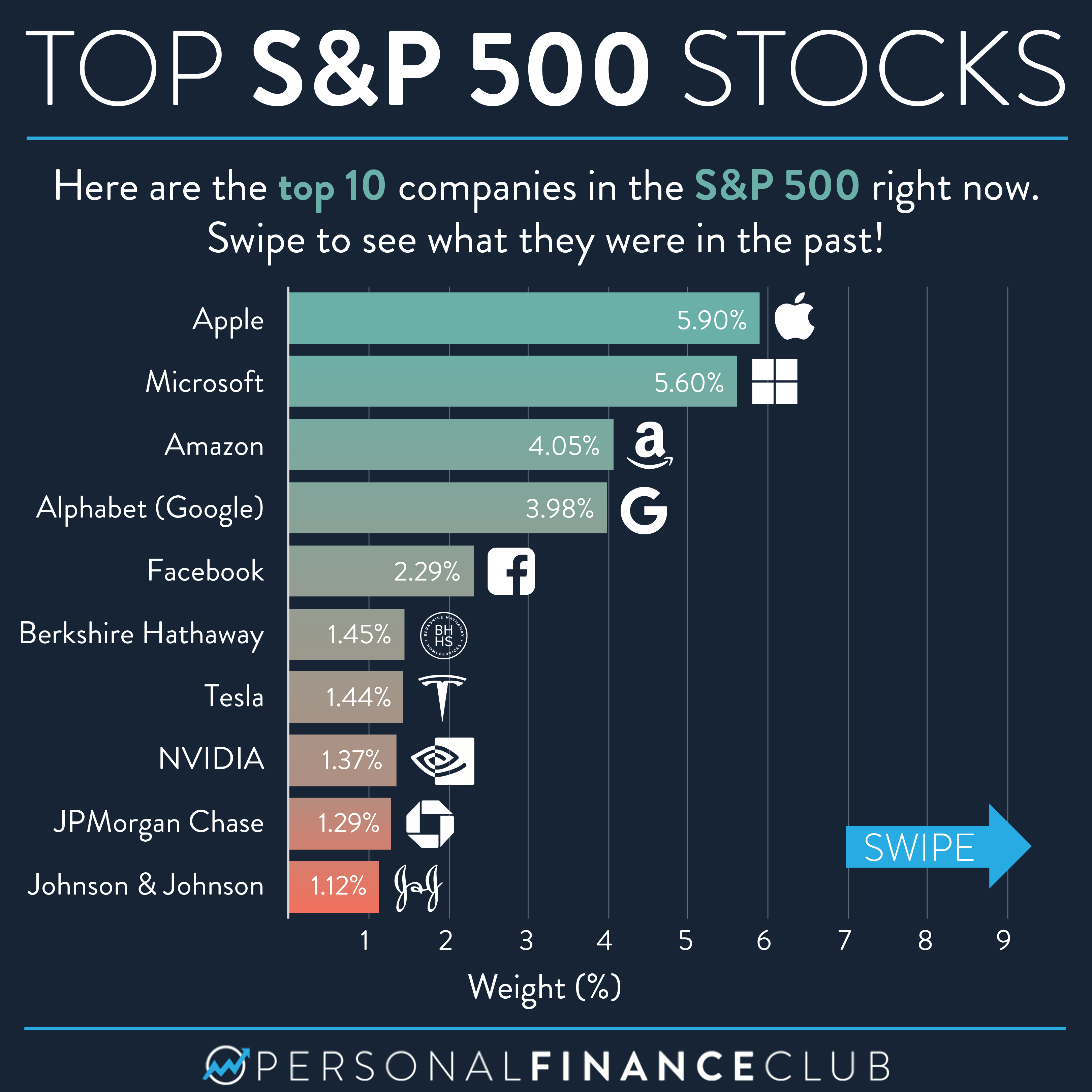

The S&P 500 is calculated using a market-capitalization-weighted methodology. This means that companies with larger market caps have a bigger influence on the index’s movement. So, if Apple or Microsoft sneezes, the whole index might catch a cold. But don’t worry, there’s a lot more to it than just a few big names. The index covers a wide range of industries, ensuring it’s not overly reliant on any one sector.

Why Does the S&P 500 Matter?

Here’s the thing: the S&P 500 isn’t just a number on a screen. It’s a reflection of the economic health of the United States. When the S&P 500 is up, it usually means companies are doing well, consumers are spending, and the economy is humming along. Conversely, when it’s down, it could signal trouble ahead. Investors, economists, and even politicians pay close attention to the S&P 500 because it provides valuable insights into the state of the economy.

For individual investors, the S&P 500 is a great benchmark for measuring the performance of their portfolios. If your investments are closely aligned with the S&P 500, you can feel pretty good about how you're doing. And let’s not forget mutual funds and ETFs that track the S&P 500, making it easier for everyday people to invest in a diversified portfolio without breaking the bank.

How Is the S&P 500 Calculated?

Now, let’s talk about the math behind the madness. The S&P 500 uses a market-capitalization-weighted approach to calculate its value. Here’s how it works: each company’s market cap is divided by the total market cap of all the companies in the index. This gives each company a weight, and their stock price movements are multiplied by that weight to determine their impact on the index.

But wait, there’s more. The S&P 500 also uses something called a divisor to adjust for things like stock splits and spin-offs. This ensures the index remains consistent over time. It’s like adding a pinch of salt to a recipe—it may seem small, but it makes a big difference.

Read also:3874512363123943876121629653062366530000334572337612398251042115129289354861239212381123983103820250303402443338911

Key Components of the S&P 500

Let’s break it down further. The S&P 500 is made up of companies from various sectors, including technology, healthcare, financials, consumer goods, and more. Here’s a quick rundown of some of the major sectors:

- Technology: Think Apple, Microsoft, and Alphabet (Google).

- Healthcare: Companies like Johnson & Johnson and Pfizer.

- Financials: Big names like JPMorgan Chase and Bank of America.

- Consumer Goods: Brands like Procter & Gamble and Coca-Cola.

Each sector plays a crucial role in the overall performance of the S&P 500. If one sector is struggling, it might drag the index down, but if another sector is thriving, it can help balance things out.

The History of the S&P 500

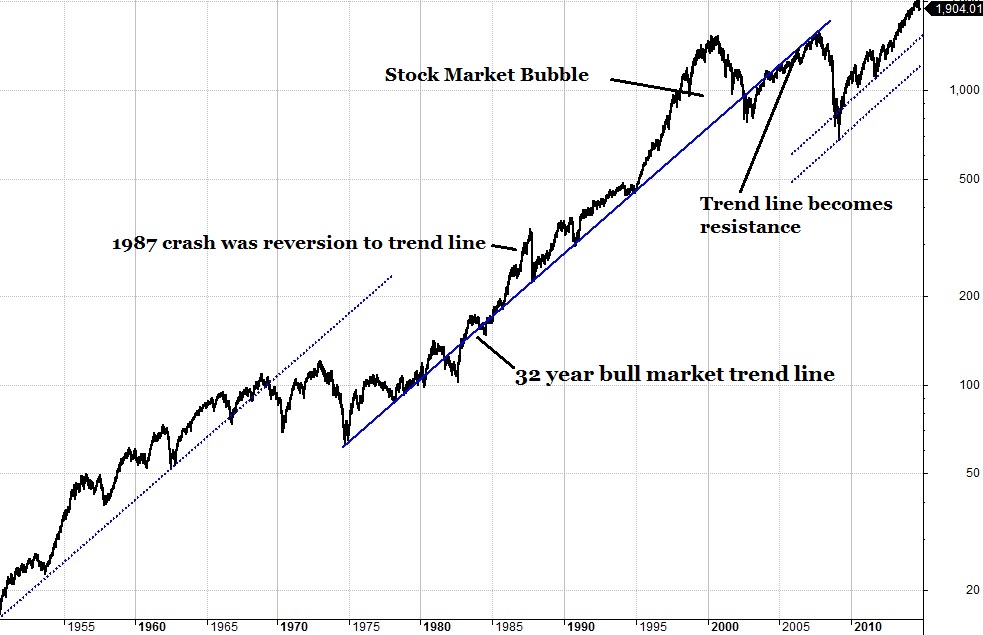

Let’s take a trip down memory lane. The S&P 500 was first introduced in 1957, making it over 60 years old. Back then, it only included industrial companies, but over the years, it has evolved to include a broader range of sectors. The goal has always been to provide a comprehensive view of the U.S. economy.

Over the decades, the S&P 500 has seen its fair share of ups and downs. From the dot-com boom in the late '90s to the financial crisis of 2008, it has weathered many storms. And through it all, it has remained a reliable indicator of economic health. It’s like the economy’s version of a weather vane—always pointing in the right direction.

How the S&P 500 Has Changed Over Time

As the U.S. economy has evolved, so has the S&P 500. In the early days, it was heavily weighted towards industrial companies. But as technology became more prominent, the index shifted to include more tech giants. Today, technology companies make up a significant portion of the S&P 500, reflecting their growing influence on the global economy.

Another interesting change is the increasing number of international companies listed on U.S. exchanges. While the S&P 500 is still primarily focused on U.S.-based companies, it’s becoming more global in nature. This reflects the interconnectedness of the modern economy.

Why Investors Love the S&P 500

Let’s talk about why investors can’t get enough of the S&P 500. First and foremost, it’s a diversified index. By investing in an S&P 500 ETF or mutual fund, you’re essentially spreading your risk across 500 companies. This reduces the chances of a single company’s poor performance wiping out your portfolio.

Another reason investors love the S&P 500 is its long-term track record. Historically, the S&P 500 has delivered solid returns over time, making it a popular choice for retirement accounts and other long-term investments. Plus, it’s relatively easy to invest in, with plenty of options available through brokers and online platforms.

Common Misconceptions About the S&P 500

There are a few misconceptions about the S&P 500 that we need to clear up. One common myth is that it only includes the largest companies by revenue. While size is a factor, it’s not the only one. Companies are also selected based on their liquidity and sector representation.

Another misconception is that the S&P 500 is only for professional investors. Wrong! Anyone can invest in the S&P 500 through ETFs and mutual funds. It’s a great way for everyday people to participate in the stock market without needing a finance degree.

The Role of the S&P 500 in the Global Economy

Now, let’s zoom out and look at the bigger picture. The S&P 500 isn’t just important for the U.S. economy; it has a ripple effect on the global economy as well. When the S&P 500 performs well, it boosts investor confidence worldwide. Conversely, a downturn in the S&P 500 can send shockwaves through global markets.

This interconnectedness is why central banks and policymakers pay close attention to the S&P 500. It’s a key indicator of economic health, and its performance can influence decisions on interest rates, monetary policy, and more. In short, the S&P 500 is more than just a number—it’s a global economic force.

How Global Events Impact the S&P 500

Global events can have a significant impact on the S&P 500. For example, the outbreak of a pandemic or a geopolitical crisis can cause volatility in the markets. But the S&P 500 has shown resilience over the years, bouncing back from crises time and time again. This resilience is one of the reasons why investors trust it as a reliable indicator of economic health.

Investing in the S&P 500: Tips and Strategies

So, you want to invest in the S&P 500? Great choice! Here are a few tips to get you started:

- Start Small: You don’t need to invest a fortune to get started. Many brokers offer fractional shares, allowing you to invest in the S&P 500 with as little as a few dollars.

- Dollar-Cost Averaging: Instead of trying to time the market, consider dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of market conditions.

- Keep It Simple: Don’t overcomplicate things. Stick with low-cost ETFs or mutual funds that track the S&P 500. They’re easy to manage and offer great diversification.

Remember, investing is a marathon, not a sprint. Focus on long-term growth and don’t get discouraged by short-term fluctuations.

Common Pitfalls to Avoid

While the S&P 500 is a great investment option, there are a few pitfalls to avoid. One common mistake is trying to time the market. No one can predict exactly when the market will go up or down, so it’s best to stick with a consistent investment strategy. Another pitfall is overreacting to short-term market movements. Stay calm and focused on your long-term goals.

The Future of the S&P 500

Looking ahead, the S&P 500 is poised to remain a key player in the global economy. As technology continues to evolve and new industries emerge, the index will adapt to reflect these changes. It’s a dynamic index that evolves with the times, ensuring it remains relevant for years to come.

One thing is for sure: the S&P 500 will continue to be a trusted indicator of economic health. Whether you’re an investor, economist, or just someone interested in how the world works, the S&P 500 is a valuable tool for understanding the global economy.

Final Thoughts

And there you have it—a comprehensive guide to understanding the S&P 500. From its history and calculation to its role in the global economy, we’ve covered it all. The S&P 500 isn’t just a number; it’s a reflection of the world we live in. So, whether you’re investing in it or simply following its movements, the S&P 500 is worth paying attention to.

Now, here’s the fun part: take action! Share this article with your friends, leave a comment below, or check out some of our other articles on finance and investing. The more you know, the better prepared you’ll be to navigate the world of finance. And who knows? You might just become the next Warren Buffett.

Table of Contents

![[글로벌 마켓] 뉴욕증시, 애플 급락에 일제히 하락…S&P500 연저점 SBS Biz](https://img.biz.sbs.co.kr/upload/2022/09/30/yP91664489650390.jpg)