Let's talk about SP500, folks. It’s not just some random set of letters—it’s the heartbeat of the global financial world. If you’ve ever wondered how Wall Street works or what drives the stock market, the SP500 is where it all begins. This index isn’t just a number; it’s a reflection of the economic pulse of the United States. Whether you’re a seasoned investor or just starting out, understanding SP500 is like having a cheat code to the stock market game.

Now, before we dive deep into the nitty-gritty details, let me set the stage for you. The SP500 is like the Hollywood of the stock market—it’s got all the big players, the biggest blockbusters, and it’s where the real action happens. But unlike Hollywood, this isn’t about glitz and glamour. It’s about numbers, trends, and making smart decisions that could impact your financial future.

What’s fascinating about SP500 is its ability to tell a story. A story of growth, resilience, and sometimes, turbulence. Think of it as a diary of the economy, where every page reveals something new about the companies that shape our world. So, buckle up, because we’re about to unravel the secrets of this financial titan.

Read also:Your Honor Cast A Deep Dive Into The Stellar Ensemble Of This Gripping Legal Drama

What Exactly is SP500?

Alright, let’s break it down. The SP500, officially called the S&P 500 Index, is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the U.S. It’s like an all-star team of companies, handpicked based on their market size, liquidity, and industry representation. From tech giants like Apple and Microsoft to consumer goods behemoths like Procter & Gamble, the SP500 covers a wide spectrum of industries.

Why does it matter? Because it’s considered a benchmark for the overall health of the U.S. economy. If the SP500 is doing well, chances are the economy is thriving. But if it takes a hit, well, that’s when things get interesting—and sometimes scary.

How SP500 Differs from Other Indices

Here’s the thing: the stock market is full of indices, but not all are created equal. The SP500 stands out because of its diverse composition. Unlike the Dow Jones Industrial Average, which focuses on just 30 companies, the SP500 gives you a broader picture. It’s like comparing a small town’s mayor’s office to the White House—both are important, but one has a much bigger impact.

- SP500 represents about 80% of the total value of the U.S. stock market.

- It’s weighted by market capitalization, meaning bigger companies have a greater influence on the index.

- It’s updated regularly to ensure it reflects the current economic landscape.

Why Should You Care About SP500?

Let’s get real for a second. The SP500 isn’t just for Wall Street wizards or financial analysts. It matters to you, whether you realize it or not. If you have a retirement account, a mutual fund, or even just a passing interest in how the economy works, the SP500 affects your life. Think of it as the weather forecast for your financial future—if it’s sunny, great. If it’s stormy, you better have an umbrella.

SP500 and Your Investment Portfolio

For investors, the SP500 is like the North Star. It’s a reliable guide for building a diversified portfolio. Many mutual funds and ETFs (Exchange-Traded Funds) are designed to track the SP500, making it easier for you to invest in a wide range of companies without having to pick stocks individually. And let’s be honest, who has time for that?

How Does SP500 Impact the Economy?

The SP500 doesn’t just sit there and look pretty. It plays a crucial role in shaping the economy. When investors see the SP500 rising, they tend to feel more confident about the market. This confidence can lead to increased spending, more investments, and ultimately, economic growth. But when it falls, well, that’s when people start getting nervous.

Read also:Triston Casas The Rising Star In Baseball

Think of it like this: the SP500 is the canary in the coal mine. It gives early warning signs of potential economic trouble. If you’re paying attention, you can make informed decisions to protect your finances.

Key Economic Indicators Linked to SP500

- GDP Growth: A rising SP500 often correlates with positive GDP growth.

- Unemployment Rates: When the SP500 is up, companies may feel more confident hiring.

- Inflation: A strong SP500 can indicate stable inflation rates.

Historical Performance of SP500

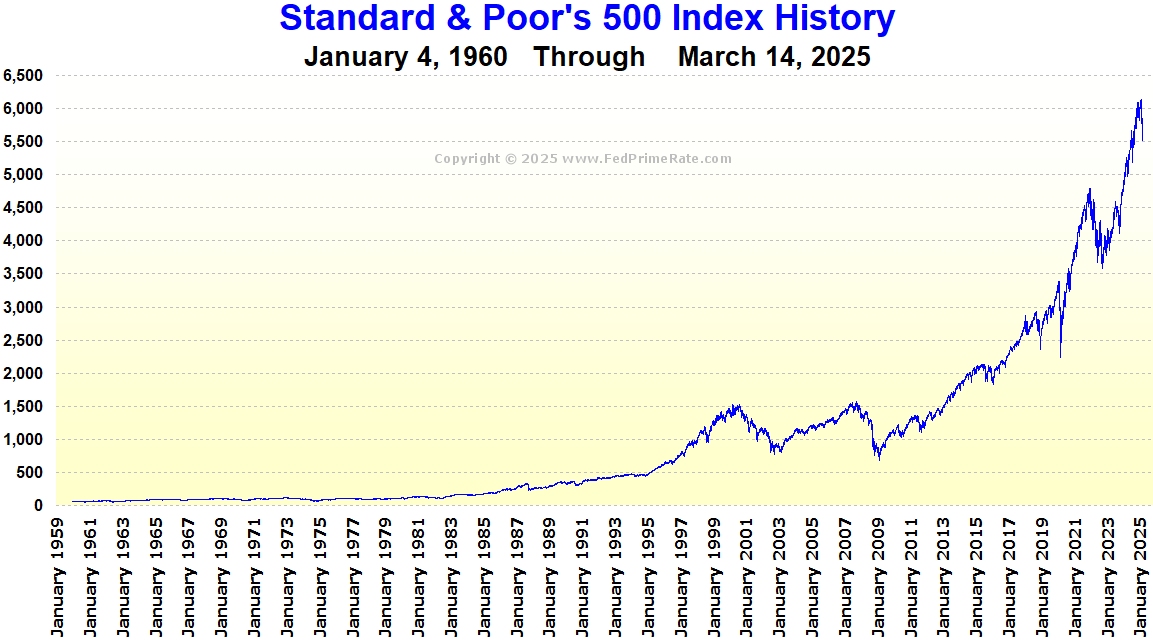

Now, let’s take a trip down memory lane. The SP500 has a rich history filled with highs and lows. Since its inception in 1957, it’s grown exponentially, weathering storms and celebrating booms. But don’t just take my word for it—let’s look at the numbers:

From 1957 to 2023, the SP500 has delivered an average annual return of around 8%. That’s not too shabby, considering the ups and downs of the market. But remember, past performance doesn’t guarantee future results. The stock market is like the ocean—calm one day, stormy the next.

Notable Events in SP500 History

- 1987: The Black Monday crash saw the SP500 plummet by over 20% in a single day.

- 2008: The global financial crisis caused the SP500 to lose nearly 40% of its value.

- 2020: Despite the pandemic, the SP500 rebounded strongly, thanks to tech stocks.

How to Invest in SP500

So, you’re ready to jump into the SP500 game? Great choice! But where do you start? The good news is, you don’t have to be a financial guru to invest in the SP500. There are several ways to get involved:

Options for SP500 Investment

- ETFs: These are like baskets of stocks that track the SP500. They’re easy to buy and sell.

- Mutual Funds: These pool money from multiple investors to invest in the SP500.

- Individual Stocks: If you want to pick and choose, you can invest in companies that are part of the SP500.

SP500 and Global Markets

The SP500 doesn’t exist in a vacuum. It’s connected to global markets in ways that can be both exciting and challenging. For instance, when the U.S. economy is strong, it can boost other economies around the world. But when it falters, the ripple effects can be felt everywhere.

International Factors Affecting SP500

- Trade Wars: Tariffs and trade disputes can impact SP500 performance.

- Global Events: Political instability or natural disasters can influence the market.

- Currency Fluctuations: A strong dollar can affect multinational companies in the SP500.

SP500 and Financial Planning

When it comes to financial planning, the SP500 is your best friend. It’s a reliable indicator of market trends and can help you make informed decisions about your future. Whether you’re saving for retirement, buying a house, or planning for your kids’ education, the SP500 can play a role in your strategy.

Tips for Using SP500 in Your Financial Plan

- Start Early: The earlier you invest, the more time your money has to grow.

- Stay Diversified: Don’t put all your eggs in one basket—spread your investments.

- Be Patient: The stock market can be volatile, but long-term trends are usually positive.

Common Misconceptions About SP500

There’s a lot of misinformation out there about the SP500. Let’s clear some of that up:

- Myth: The SP500 only benefits the rich. Truth: Anyone can invest in the SP500 through ETFs or mutual funds.

- Myth: It’s too risky. Truth: While there are risks, the long-term trend is generally upward.

- Myth: You need a lot of money to start. Truth: Many platforms allow you to invest with as little as $1.

Conclusion

There you have it, folks. The SP500 isn’t just a number—it’s a powerful tool for understanding the stock market and planning your financial future. Whether you’re a seasoned investor or just starting out, the SP500 offers insights and opportunities that can’t be ignored.

So, what’s next? Take action! Start educating yourself about the SP500, explore investment options, and don’t be afraid to ask questions. The stock market can be intimidating, but with the right knowledge and tools, you can navigate it like a pro.

And remember, the SP500 is your friend. Treat it well, and it might just return the favor. Now, go out there and make your financial dreams a reality!

Table of Contents