Listen up, folks. If you're even remotely interested in the world of tech and investing, AMD stock is something you need to pay attention to right now. The semiconductor giant has been on an absolute tear, delivering jaw-dropping performance that's turning heads across Wall Street. This isn't just another stock; it's a powerhouse that's redefining the landscape of modern computing. Whether you're a seasoned investor or just dipping your toes into the stock market, AMD deserves a spot on your radar.

In today's cutthroat market, finding a stock with true potential is like finding a diamond in the rough. AMD stock isn't just shining—it's blazing like a supernova. The company behind some of the most powerful processors in the world has been making waves, and for good reason. From gaming to data centers, AMD's technology is at the forefront of innovation, driving industries forward and setting new benchmarks.

But here's the kicker: this isn't just about technology. It's about opportunity. As we dive deeper into the world of AMD stock, you'll discover why this company is more than just a player in the semiconductor game—it's a game-changer. So grab a coffee, sit back, and let's break down why AMD stock could be the next big thing in your portfolio.

Read also:3265439135123983974921147123921238112398310382025030340244333891165306228232668112398260321237512356214873302124615

Understanding AMD Stock: A Beginner's Guide

Before we dive headfirst into the nitty-gritty, let's take a moment to understand what AMD stock is all about. Advanced Micro Devices, or AMD as it's commonly known, is a tech powerhouse that designs and develops cutting-edge processors and graphics cards. Their stock, traded under the ticker symbol AMD, has been a favorite among tech-savvy investors for years. But what exactly makes AMD stock so special?

Think of AMD as the underdog that keeps proving everyone wrong. Back in the day, they were often overshadowed by competitors like Intel, but fast forward to today, and it's a completely different story. AMD has been delivering record-breaking performance, consistently outpacing expectations and setting new standards in the industry. This isn't just about numbers; it's about innovation, resilience, and a commitment to pushing boundaries.

Why AMD Stock Stands Out

Here's the deal: AMD stock isn't just about hardware. It's about vision. The company has been laser-focused on delivering products that meet the demands of today's digital world. From high-performance CPUs to energy-efficient GPUs, AMD is catering to a market that's hungry for power and efficiency. And guess what? It's paying off big time.

- Innovative product lineup that's redefining computing

- Strong financial performance with consistent growth

- A strategic focus on emerging markets like AI and cloud computing

- Leadership that understands the pulse of the industry

These factors, combined with a robust pipeline of new products, make AMD stock a compelling choice for investors looking to capitalize on the tech boom.

AMD Stock Performance: The Numbers Don't Lie

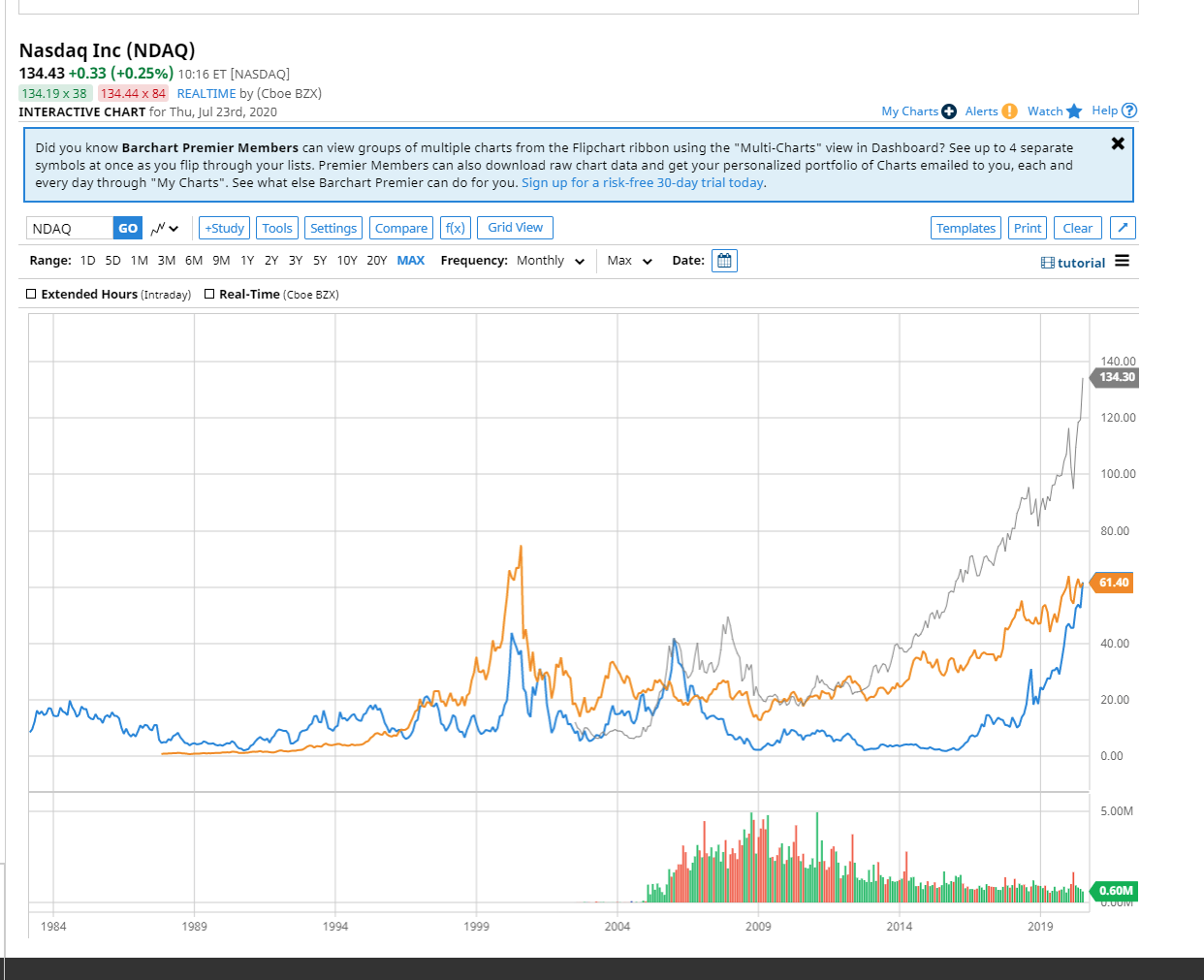

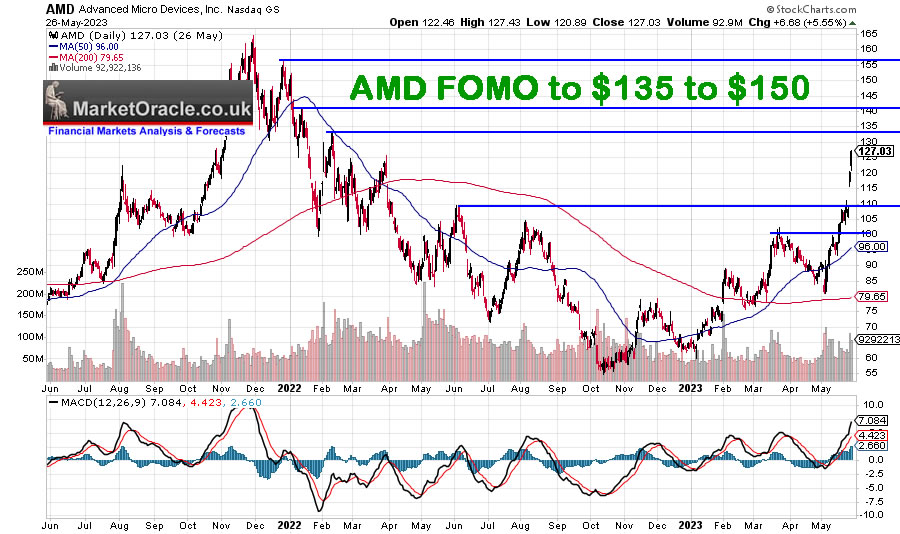

Let's talk numbers, because let's face it, that's what matters most when it comes to investing. AMD stock has been on a roll, delivering returns that have left even the most seasoned investors impressed. Over the past few years, the stock has seen exponential growth, outperforming many of its peers in the semiconductor space.

In 2023 alone, AMD stock has shown remarkable resilience, with year-to-date gains that have outpaced the broader market. The company's ability to deliver consistent earnings beats and revenue growth has been a key driver of this performance. But what's really exciting is the potential that lies ahead. As the demand for computing power continues to grow, AMD is well-positioned to capitalize on this trend.

Read also:Is Fabio Quartararo Married The Untold Story Of Fabiorsquos Love Life

Key Financial Metrics to Watch

When evaluating AMD stock, there are a few key metrics that every investor should keep an eye on. These numbers tell the story of AMD's financial health and growth potential:

- Revenue growth: AMD has consistently delivered double-digit revenue growth, a testament to its expanding market presence.

- Earnings per share (EPS): AMD's EPS has been on an upward trajectory, reflecting the company's improving profitability.

- Operating margin: The company's operating margin has been expanding, indicating better cost management and operational efficiency.

These metrics, along with a strong balance sheet, make AMD stock an attractive option for both growth and value investors.

AMD Stock vs. Competitors: Who's Winning?

When it comes to the semiconductor industry, AMD isn't the only player in town. Companies like Intel and NVIDIA are also vying for market share, but AMD has been making waves with its aggressive strategy and innovative products. So how does AMD stock stack up against its competitors?

The answer lies in AMD's ability to deliver products that meet the evolving needs of consumers and businesses alike. Whether it's powerful processors for gaming or energy-efficient solutions for data centers, AMD has been ahead of the curve. This competitive edge has translated into market share gains and increased customer loyalty, both of which are crucial for long-term success.

Key Differentiators of AMD Stock

Here's what sets AMD apart from the competition:

- Strong focus on R&D, leading to groundbreaking products

- A diversified product portfolio that caters to multiple markets

- Strategic partnerships with key players in the tech industry

These factors, combined with a forward-thinking approach, make AMD stock a formidable contender in the semiconductor space.

Market Trends Driving AMD Stock Growth

The world of tech is constantly evolving, and AMD stock is riding the wave of several key trends that are reshaping the industry. From artificial intelligence to cloud computing, AMD is at the forefront of innovation, positioning itself to benefit from these transformative forces.

One of the biggest drivers of AMD stock growth is the increasing demand for high-performance computing. As industries like healthcare, finance, and entertainment embrace AI and machine learning, the need for powerful processors has never been greater. AMD's cutting-edge technology is meeting this demand head-on, making it a key player in the AI revolution.

Emerging Markets to Watch

Beyond AI, there are several other markets that are driving AMD stock growth:

- Data centers: AMD's energy-efficient solutions are making waves in the data center space.

- Gaming: The gaming industry continues to grow, and AMD's GPUs are powering some of the best gaming experiences.

- 5G: As the world transitions to 5G, AMD's technology is playing a crucial role in enabling faster, more reliable connectivity.

These markets represent significant opportunities for AMD stock, and the company is well-positioned to capitalize on them.

AMD Stock: Risks and Challenges

While AMD stock has been on a tear, it's important to acknowledge the risks and challenges that come with investing in any company. The semiconductor industry is highly competitive, and AMD isn't immune to market fluctuations and external factors.

One of the biggest risks facing AMD stock is the potential for supply chain disruptions. As the world becomes increasingly interconnected, any disruption in the supply chain can have a significant impact on AMD's operations. Additionally, the company faces intense competition from rivals like Intel and NVIDIA, both of which are investing heavily in R&D to maintain their market position.

How AMD is Mitigating Risks

Despite these challenges, AMD is taking proactive steps to mitigate risks and ensure long-term success:

- Investing in R&D to maintain a competitive edge

- Expanding its product portfolio to diversify revenue streams

- Building strategic partnerships to strengthen its market position

By addressing these risks head-on, AMD is positioning itself to thrive in an ever-changing market.

Investor Sentiment and AMD Stock

When it comes to AMD stock, investor sentiment is overwhelmingly positive. Analysts and experts alike are bullish on the company's prospects, citing its strong financial performance and innovative product lineup as key drivers of future growth. This sentiment is reflected in the stock's price action, which has been consistently trending upwards.

But what do the numbers say? According to recent surveys, a majority of analysts have a "buy" or "strong buy" rating on AMD stock, indicating strong confidence in its future performance. This sentiment is further bolstered by AMD's track record of delivering on its promises and exceeding expectations.

What Investors Are Saying

Here's what some of the top investors are saying about AMD stock:

- "AMD is redefining the semiconductor industry with its innovative approach." – Analyst at Morgan Stanley

- "The company's focus on R&D is paying off in a big way." – Investor at BlackRock

- "AMD stock is a must-have for any tech portfolio." – Portfolio Manager at Vanguard

These insights provide valuable context for anyone considering AMD stock as part of their investment strategy.

Future Outlook for AMD Stock

Looking ahead, the future of AMD stock looks brighter than ever. With a strong pipeline of new products and a growing presence in key markets, the company is well-positioned to continue its upward trajectory. But what does this mean for investors?

The short answer is opportunity. As AMD continues to innovate and expand its reach, the potential for growth remains significant. Whether it's through new product launches or strategic acquisitions, AMD is poised to deliver value to its shareholders in the years to come.

Key Catalysts for Growth

Here are some of the key catalysts that could drive AMD stock growth in the future:

- Expansion into new markets like AI and cloud computing

- Introduction of next-generation products

- Increased adoption of AMD technology in data centers and gaming

These catalysts, combined with a strong financial foundation, make AMD stock a compelling investment opportunity.

How to Invest in AMD Stock

Ready to take the plunge and invest in AMD stock? Here's what you need to know. The first step is to open a brokerage account with a reputable firm. Once you've done that, you can start buying shares of AMD stock through your account. It's important to do your research and understand the risks involved, but with the right strategy, AMD stock could be a valuable addition to your portfolio.

When investing in AMD stock, consider factors like your risk tolerance, investment goals, and time horizon. Diversification is also key, so don't put all your eggs in one basket. By taking a balanced approach, you can maximize your returns while minimizing your risk.

Conclusion: Why AMD Stock is Worth Your Attention

As we wrap up our deep dive into AMD stock, it's clear that this isn't just another tech stock—it's a game-changer. From its innovative products to its strong financial performance, AMD is redefining what it means to be a leader in the semiconductor industry. Whether you're a seasoned investor or just starting out, AMD stock deserves a spot on your radar.

So what are you waiting for? Take action today by doing your research, opening a brokerage account, and adding AMD stock to your portfolio. And don't forget to share this article with your friends and fellow investors. The more people know about AMD stock, the better equipped they'll be to make informed investment decisions.

Table of Contents

- Understanding AMD Stock: A Beginner's Guide

- AMD Stock Performance: The Numbers Don't Lie

- AMD Stock vs. Competitors: Who's Winning?

- Market Trends Driving AMD Stock Growth

- AMD Stock: Risks and Challenges

- Investor Sentiment and AMD Stock

- Future Outlook for AMD Stock

- How to Invest in AMD Stock

- Conclusion: Why AMD Stock is Worth Your Attention