Let’s talk about US Steel Stock. If you’re looking to dip your toes into the world of heavy-duty investments, this might just be the ticket you’ve been waiting for. The steel industry has always been a cornerstone of economic growth, and US Steel Corporation is no stranger to making waves in this space. Whether you're a seasoned investor or someone who's just getting their feet wet, understanding the ins and outs of US Steel Stock could open doors to some serious financial opportunities.

Now, I know what you're thinking – "steel? Really?" But hear me out. This isn't just about chunks of metal; it's about the backbone of infrastructure, manufacturing, and pretty much everything that keeps our modern world running. US Steel Stock has been around for over a century, and while it’s had its ups and downs, it’s still standing strong. And when you’re dealing with stocks, resilience is key.

Before we dive deep into the nitty-gritty, let me set the stage. US Steel Stock isn’t just a name on a ticker; it’s a symbol of industrial power. From its roots in Pittsburgh to its current global reach, this company has seen it all. So, if you’re ready to learn why US Steel Stock might be worth your time (and money), let’s get started. No pressure, but by the end of this, you might just feel like a stock market guru.

Read also:Eric Martin Wife The Untold Story Of Love Life And Music

Understanding US Steel Stock: A Beginner's Guide

First things first – let’s break down what exactly US Steel Stock is all about. At its core, US Steel Stock represents ownership in US Steel Corporation, one of the largest steel producers in North America. When you buy a share of US Steel Stock, you're essentially buying a tiny piece of a company that’s been shaping industries for over 120 years. Pretty cool, right?

Now, here’s the kicker: steel isn’t just a raw material; it’s a vital component in almost every major industry out there. From construction and automotive to energy and appliances, steel is everywhere. And as economies grow, so does the demand for steel. That’s where US Steel Stock comes in – it gives investors a chance to capitalize on this demand while riding the wave of industrial progress.

Why US Steel Stock Matters in Today’s Market

Let’s face it – the stock market can be a wild ride. But US Steel Stock offers something unique: stability with potential for growth. With the global push towards infrastructure development and green energy initiatives, steel demand is expected to skyrocket. And guess who’s perfectly positioned to capitalize on that? You guessed it – US Steel Corporation.

Here’s the deal: while tech stocks might get all the glory, industrial stocks like US Steel Stock are the unsung heroes of the market. They may not have the flashy headlines, but they deliver consistent value over time. Plus, with the current administration’s focus on rebuilding America’s infrastructure, US Steel Stock could see a major boost in the near future. It’s like hitting the sweet spot of timing and opportunity.

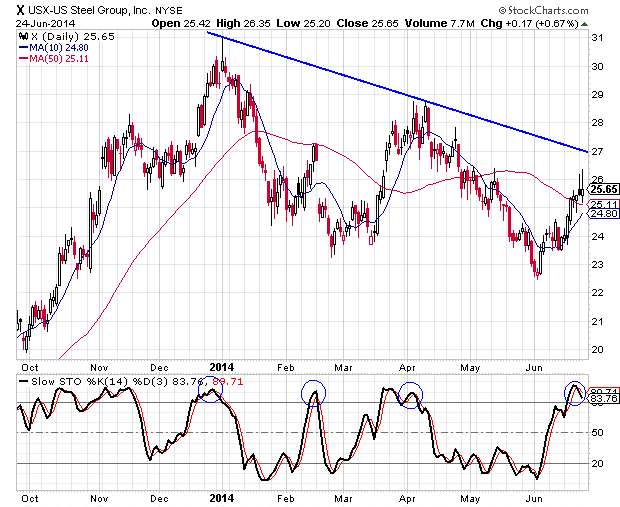

Breaking Down the Numbers: US Steel Stock Performance

Alright, let’s talk numbers. If you’re thinking about investing in US Steel Stock, you’ll want to know how it’s been performing. Over the past few years, US Steel Stock has shown some pretty impressive gains, especially during periods of increased steel demand. For instance, in 2021 alone, the stock saw a staggering increase, driven by a surge in global steel prices.

But here’s the thing – investing isn’t just about past performance; it’s about future potential. Analysts predict that as economies continue to recover from the pandemic and infrastructure projects pick up steam, US Steel Stock could see even more growth. Of course, there are risks involved, but isn’t that the beauty of investing?

Read also:Mary Mouser Erome Unveiling The Star Beyond The Spotlight

Key Metrics to Watch in US Steel Stock

When it comes to evaluating US Steel Stock, there are a few key metrics you’ll want to keep an eye on. First up is the Price-to-Earnings (P/E) ratio, which gives you an idea of how much investors are willing to pay for each dollar of earnings. For US Steel Stock, this ratio has been fluctuating, but it’s generally in line with industry standards.

Another important metric is the Debt-to-Equity ratio. This tells you how much debt the company has relative to its equity. For US Steel Corporation, managing debt has been a priority, and recent efforts to reduce liabilities have been paying off. Plus, with a solid revenue stream and a focus on operational efficiency, the company is well-positioned to handle any challenges that come its way.

Historical Overview of US Steel Stock

Let’s take a trip down memory lane and explore the history of US Steel Stock. Founded in 1901, US Steel Corporation quickly became the largest steel producer in the world. Back in the day, steel was the lifeblood of industrialization, and US Steel was at the forefront of it all. Over the years, the company has weathered economic storms, navigated changing market dynamics, and remained a powerhouse in the industry.

Of course, like any company, US Steel Stock has faced its share of challenges. The rise of foreign competition, fluctuating steel prices, and shifts in global trade policies have all had an impact. But through it all, the company has adapted and evolved, proving time and again that it’s here to stay. And as the world moves towards a more sustainable future, US Steel Corporation is investing in green technologies to ensure its relevance in the years to come.

Major Milestones in US Steel Stock History

Here’s a quick rundown of some of the key moments in US Steel Stock history:

- 1901 – US Steel Corporation is founded, becoming the largest steel producer in the world.

- 1980s – The company faces stiff competition from foreign steel producers, prompting a shift in strategy.

- 2000s – US Steel Stock undergoes modernization efforts to improve efficiency and reduce costs.

- 2020s – The company focuses on sustainability and innovation, aligning with global trends.

Each of these milestones has shaped the company into what it is today – a resilient player in the steel industry with a vision for the future.

Current Trends Affecting US Steel Stock

Now that we’ve covered the history, let’s talk about what’s happening right now. The steel industry is undergoing some major changes, and US Steel Stock is right in the middle of it all. One of the biggest trends is the push towards sustainable practices. With environmental regulations tightening and consumers demanding greener products, US Steel Corporation is investing heavily in technologies that reduce carbon emissions.

Another trend to watch is the global trade landscape. Tariffs and trade policies can have a significant impact on steel prices, which in turn affects US Steel Stock performance. As countries negotiate trade agreements and impose tariffs, investors need to stay informed and adapt accordingly. But despite these challenges, US Steel Stock remains a strong contender in the market.

How Global Events Impact US Steel Stock

Global events, such as geopolitical tensions and economic shifts, can have a ripple effect on US Steel Stock. For example, the pandemic disrupted supply chains and temporarily reduced demand for steel. However, as economies rebounded, so did the demand for steel, giving US Steel Stock a much-needed boost.

Additionally, the push for infrastructure development in countries like the United States and China is expected to drive steel demand in the coming years. This could translate into higher revenues and stock prices for US Steel Corporation. So, while global events can create uncertainty, they also present opportunities for savvy investors.

Investor Sentiment and US Steel Stock

Investor sentiment plays a crucial role in the performance of any stock, and US Steel Stock is no exception. Right now, sentiment towards US Steel Stock is cautiously optimistic. Analysts are bullish on the stock’s potential, especially given the company’s focus on innovation and sustainability. However, some investors remain cautious due to the inherent risks in the steel industry.

Here’s the thing – investing in US Steel Stock requires a long-term mindset. While short-term fluctuations are inevitable, the company’s strong fundamentals and strategic initiatives make it a compelling choice for those willing to play the waiting game. And let’s be honest – patience often pays off in the stock market.

What Analysts Are Saying About US Steel Stock

So, what are the experts saying? Most analysts agree that US Steel Stock has strong growth potential, especially as the global economy continues to recover. Some have even upgraded their ratings, citing the company’s efforts to reduce debt and improve operational efficiency. Of course, there are dissenting voices, but that’s the beauty of the stock market – it’s all about perspective.

One thing is clear, though – US Steel Stock is on the radar of many investors, and for good reason. With its rich history, strategic vision, and solid financials, it’s a stock worth considering for those looking to diversify their portfolios.

Risks and Challenges for US Steel Stock

Of course, no investment is without risks, and US Steel Stock is no exception. One of the biggest challenges facing the company is competition from foreign steel producers. With lower production costs and government subsidies, these competitors can often undercut US Steel Corporation’s prices. However, the company is working hard to level the playing field through innovation and efficiency improvements.

Another risk to consider is the cyclical nature of the steel industry. Steel demand tends to rise and fall with economic cycles, which can lead to volatility in US Steel Stock prices. Additionally, environmental regulations and trade policies can pose challenges, but they also present opportunities for the company to differentiate itself through sustainable practices.

How US Steel Stock is Addressing These Challenges

To tackle these challenges, US Steel Corporation is taking a multi-faceted approach. First, the company is investing in advanced technologies to improve efficiency and reduce costs. This includes automation, digitalization, and the use of artificial intelligence in operations. Second, US Steel Stock is focusing on sustainability, developing greener production methods and products that appeal to eco-conscious consumers.

Furthermore, the company is actively engaging with policymakers to address trade issues and ensure a level playing field. By staying proactive and adaptable, US Steel Corporation is well-positioned to navigate the challenges ahead and continue delivering value to its shareholders.

Future Prospects for US Steel Stock

Looking ahead, the future of US Steel Stock looks promising. With the global focus on infrastructure development and sustainable practices, the demand for steel is expected to grow. And as one of the leading players in the industry, US Steel Corporation is poised to benefit from this trend.

Additionally, the company’s commitment to innovation and operational excellence positions it well for long-term success. Whether it’s through new product lines, strategic partnerships, or advancements in technology, US Steel Stock has the potential to deliver solid returns for investors willing to take the plunge.

Final Thoughts on US Steel Stock

In conclusion, US Steel Stock offers a unique opportunity for investors looking to tap into the industrial sector. With its rich history, strong fundamentals, and forward-thinking strategies, it’s a stock worth considering for those seeking both stability and growth. Of course, like any investment, it comes with risks, but with careful analysis and a long-term perspective, US Steel Stock could be a valuable addition to your portfolio.

So, what are you waiting for? Dive into the world of US Steel Stock and see where it takes you. And don’t forget to share your thoughts in the comments below or check out our other articles for more insights into the stock market. Happy investing!

Table of Contents

Understanding US Steel Stock: A Beginner's Guide

Why US Steel Stock Matters in Today’s Market

Breaking Down the Numbers: US Steel Stock Performance

Key Metrics to Watch in US Steel Stock

Historical Overview of US Steel Stock

Major Milestones in US Steel Stock History

Current Trends Affecting US Steel Stock

How Global Events Impact US Steel Stock

Investor Sentiment and US Steel Stock

What Analysts Are Saying About US Steel Stock