Hey there, tax adventurer! If you've been scratching your head over the mysterious world of 1099-G forms and Colorado tax refunds, you're not alone. Every year, thousands of folks in Colorado find themselves tangled up in the complexities of state tax returns. The 1099-G form is like a treasure map, but instead of gold, it leads to your hard-earned cash. So, let's dive deep into this topic and make sure you're getting every penny you deserve.

Whether you're a freelancer, a small business owner, or someone who received unemployment benefits, understanding the 1099-G form is crucial. It's the key to ensuring you don't overpay or miss out on a refund. This guide will break down everything you need to know about the 1099-G form and how it impacts your Colorado tax refund.

Let's not sugarcoat it—taxes can be a headache. But with the right info, you can turn that headache into a win. So, buckle up, and let's unravel the mystery of the 1099-G form and your Colorado tax refund together!

Read also:Hyungry Leak The Untold Story Behind The Hype

What is the 1099-G Form All About?

Alright, let's start with the basics. The 1099-G form is like a report card for your finances. It's issued by government agencies or employers when they've paid you money that might be taxable. This could include unemployment benefits, state tax refunds from previous years, or other payments made to you. In Colorado, this form plays a big role in determining how much tax you owe—or how much you're owed back.

Here's the kicker: If you got a tax refund last year, that refund might show up on a 1099-G form this year. It's like paying taxes on your tax refund. Sounds wild, right? But don't worry, we'll break it all down for you.

Who Gets a 1099-G Form?

Not everyone gets a 1099-G form. It's typically sent to individuals who received:

- State or local tax refunds

- Unemployment compensation

- Other government payments

If you fall into any of these categories, chances are you'll be seeing a 1099-G form in your mailbox. And yes, Colorado is no exception. The state sends out these forms to help you accurately report your income on your federal and state tax returns.

Why Does the 1099-G Form Matter for Colorado Tax Refunds?

Here's where things get interesting. If you received a tax refund from Colorado last year, that refund might affect your taxes this year. The 1099-G form reports the amount of your refund, which could be taxable depending on your situation. It's like a domino effect—your refund from last year impacts your taxes this year.

But here's the good news: Not all refunds are taxable. If you itemized deductions last year and got a refund, part of that refund might not be taxable. It all depends on your specific tax situation. That's why it's so important to understand the details of your 1099-G form.

Read also:Did Barron Trump Sing On Americas Got Talent Unveiling The Truth Behind The Buzz

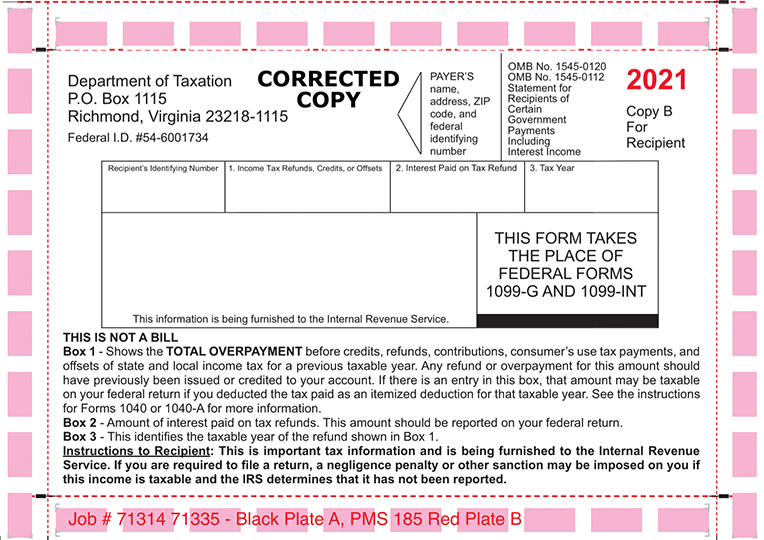

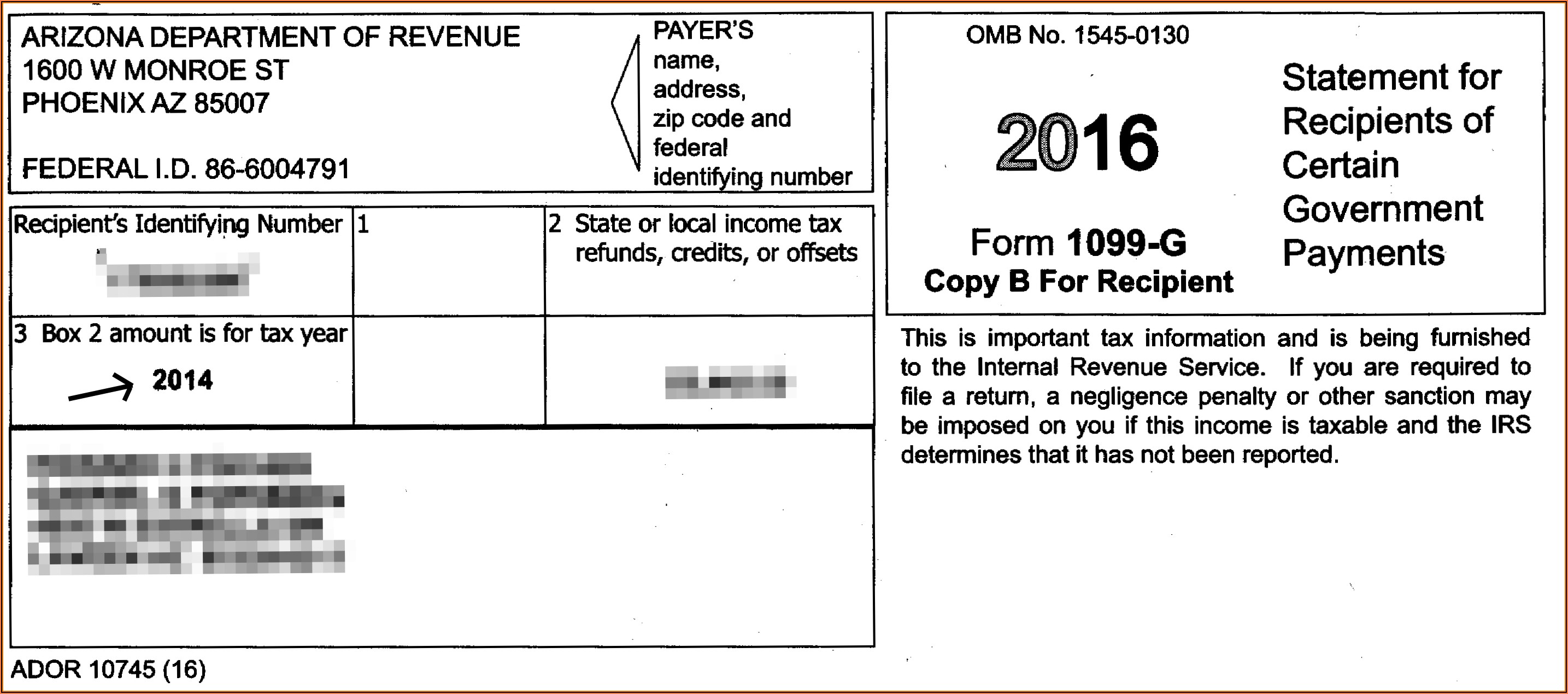

How to Read Your 1099-G Form

The 1099-G form might look like a bunch of numbers and codes, but once you know what to look for, it's pretty straightforward. Here's a quick breakdown:

- Box 1: Shows the total amount of your state or local tax refund.

- Box 3: Reports unemployment compensation.

- Box 5: Includes other income, like government payments.

Understanding these boxes is key to accurately reporting your income on your tax return. Don't skip over any details—every number matters when it comes to your refund.

Steps to Claim Your Colorado Tax Refund

Now that you know what the 1099-G form is all about, let's talk about how to claim your Colorado tax refund. Here's a step-by-step guide to help you navigate the process:

Step 1: Gather Your Documents

You'll need your 1099-G form, W-2s, and any other tax documents you've received. Make sure everything is organized and easy to access. This will save you a ton of time when filling out your tax return.

Step 2: File Your Taxes

Whether you're using tax software or working with a professional, make sure you accurately report the information from your 1099-G form. Double-check all the numbers to avoid any mistakes that could delay your refund.

Step 3: Check Your Refund Status

Once you've filed your taxes, you can check the status of your Colorado tax refund online. The Colorado Department of Revenue has a handy tool that lets you track your refund in real-time. It's like watching your refund journey unfold before your eyes.

Common Mistakes to Avoid

When it comes to taxes, mistakes can cost you big time. Here are some common pitfalls to watch out for:

- Forgetting to Report Your Refund: If you received a refund last year, make sure to include it on your tax return this year.

- Not Adjusting for Itemized Deductions: If you itemized deductions last year, part of your refund might not be taxable. Don't overpay by not adjusting for this.

- Ignoring Unemployment Compensation: If you received unemployment benefits, they might be taxable. Don't forget to report them on your 1099-G form.

By avoiding these common mistakes, you'll be well on your way to maximizing your Colorado tax refund.

Tips for Maximizing Your Refund

Who doesn't love a bigger refund? Here are some tips to help you maximize your Colorado tax refund:

Tip 1: Itemize Deductions

If your itemized deductions are higher than the standard deduction, claiming them could increase your refund. Make sure to keep track of all your deductible expenses throughout the year.

Tip 2: Claim All Credits You Qualify For

Don't leave money on the table! Credits like the Earned Income Tax Credit (EITC) or Child Tax Credit can significantly boost your refund. Do your research and make sure you're claiming every credit you're eligible for.

Tip 3: File Early

The earlier you file, the sooner you'll get your refund. Plus, filing early can help protect you from identity theft. It's a win-win!

Understanding Tax Deadlines

Knowing the tax deadlines is crucial for a smooth filing process. In Colorado, the tax deadline usually aligns with the federal deadline, which is typically April 15th. However, if that date falls on a weekend or holiday, the deadline might be extended.

Pro tip: Don't wait until the last minute to file. Give yourself plenty of time to gather your documents, review your return, and submit everything on time. Missing the deadline can result in penalties and interest charges.

What Happens If You Miss the Deadline?

If you miss the tax deadline, don't panic. You can still file your return, but you might face penalties for late filing. The sooner you file, the less you'll owe in penalties. And if you're owed a refund, filing late won't affect the amount you receive—though it might delay when you get it.

Seeking Professional Help

If all this talk about 1099-G forms and tax refunds has your head spinning, don't hesitate to seek professional help. A good tax preparer or accountant can guide you through the process and ensure you're getting the best possible outcome.

When choosing a professional, look for someone who specializes in Colorado tax law. They'll have the expertise to navigate the specifics of your situation and help you maximize your refund.

Questions to Ask a Tax Professional

Before hiring a tax professional, here are some questions to ask:

- How many years of experience do you have with Colorado taxes?

- Do you specialize in working with freelancers, small businesses, or individuals?

- What is your success rate in maximizing refunds?

Getting the right answers to these questions can help you find the perfect professional to assist you.

Conclusion: Your Path to a Bigger Refund

Alright, tax warrior, you've made it to the end of our ultimate guide to the 1099-G form and Colorado tax refunds. By now, you should have a solid understanding of how the 1099-G form impacts your taxes and how to claim your refund. Remember, knowledge is power—and in this case, power equals money in your pocket.

So, here's your call to action: Take what you've learned and put it into practice. Gather your documents, file your taxes, and keep an eye on your refund status. And don't forget to share this article with anyone who could benefit from it. Together, we can demystify the world of taxes and help everyone get the refunds they deserve.

Until next time, stay tax-savvy and keep those refunds coming!

Table of Contents