When it comes to investing, understanding the QQQ stock price chart is like having a treasure map for modern-day treasure hunters. It's not just numbers on a screen; it's a story of market trends, investor sentiment, and the pulse of some of the world's biggest tech giants. Whether you're a seasoned trader or a newbie looking to dip your toes into the stock market, the QQQ ETF has got your back. This bad boy tracks the Nasdaq-100 Index, which is packed with tech heavyweights like Apple, Microsoft, and Tesla. So, buckle up because we're diving deep into the world of QQQ stock charts, and trust me, it's gonna be a wild ride.

Now, you might be wondering, "Why should I care about the QQQ stock price chart?" Well, my friend, think of it as your personal weather forecast for the stock market. Just like you wouldn’t go camping without checking the weather, you shouldn’t invest without understanding what the QQQ chart is telling you. It’s a powerful tool that can help you make informed decisions, spot trends, and even time the market—if you're into that kinda thing.

Before we dive into the nitty-gritty, let me give you a little teaser. By the end of this article, you’ll know how to read a QQQ stock price chart like a pro, understand the factors that influence its movements, and even learn some tricks to maximize your returns. So, grab your favorite drink, get comfy, and let’s unravel the mysteries of the QQQ stock price chart together.

Read also:Is Kelly Reardon Married The Truth Behind The Relationship Status

Understanding the Basics of QQQ Stock Price Chart

First things first, let’s break down what the QQQ stock price chart actually is. At its core, the QQQ chart is a visual representation of how the Invesco QQQ Trust, or simply QQQ ETF, has performed over time. It’s like a graph that shows the ups and downs of the Nasdaq-100 Index, which includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market. These aren’t just any companies; we’re talking about tech titans, consumer giants, and biotech innovators.

Here’s the kicker: the QQQ ETF isn’t just a random collection of stocks. It’s designed to reflect the performance of the tech-heavy Nasdaq-100, which means it’s heavily influenced by the tech sector. So, if you see a sudden spike or dip in the QQQ stock price chart, chances are it’s related to something big happening in the tech world. Whether it’s Apple launching a new iPhone or Tesla unveiling its latest electric vehicle, these events can have a ripple effect on the entire chart.

Key Components of a QQQ Stock Price Chart

Now that you know what the QQQ stock price chart is, let’s talk about its key components. Every chart has its own language, and understanding this language is crucial if you want to make sense of the data. Here are some of the main elements you’ll find on a QQQ chart:

- Price Movements: This is the most obvious part of the chart. It shows how the price of QQQ has changed over time. You’ll see lines going up and down, and each movement tells a story.

- Volume: Volume is like the heartbeat of the market. It shows how many shares of QQQ were traded at a particular time. High volume usually indicates strong interest or activity in the market.

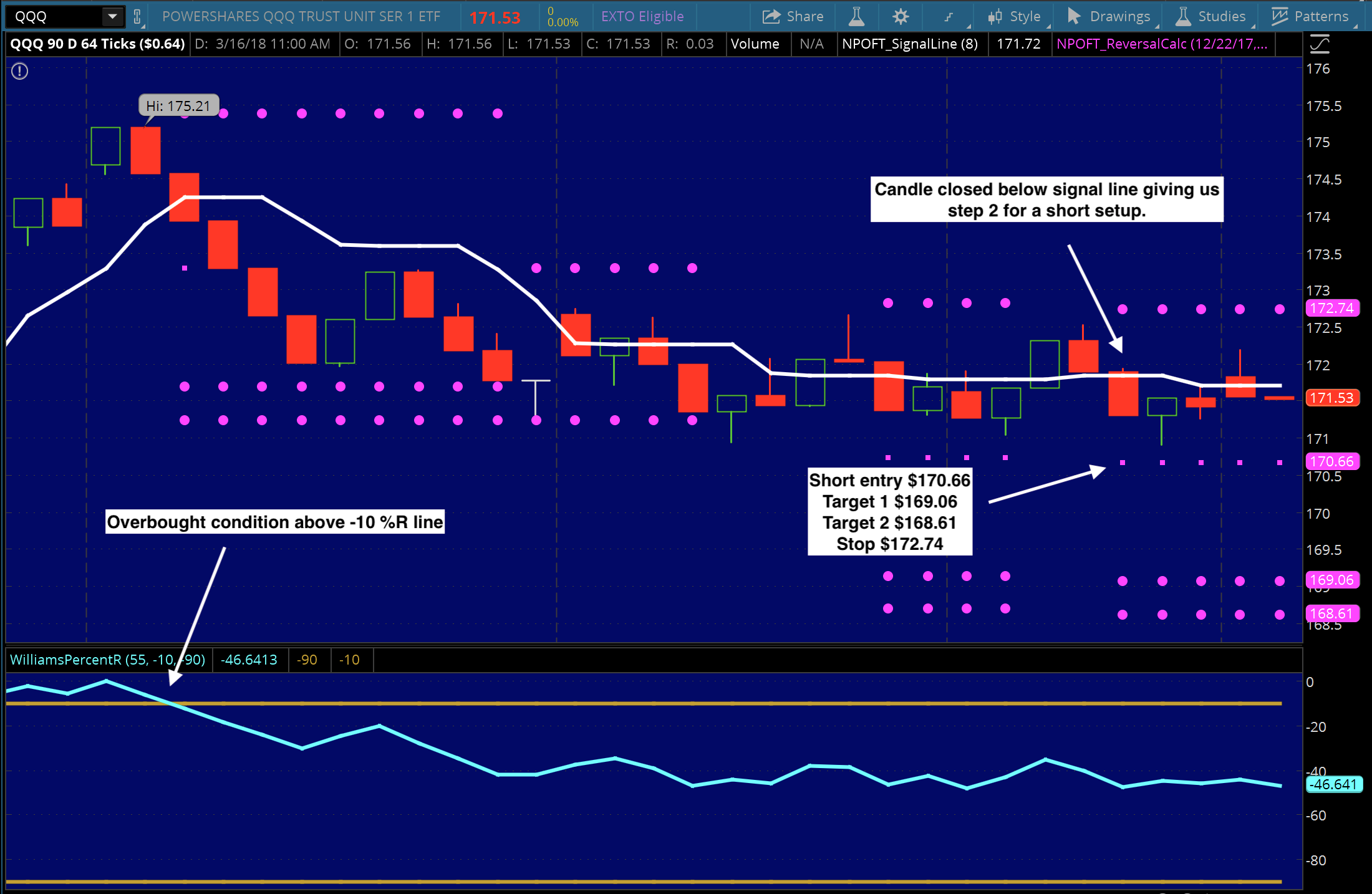

- Technical Indicators: These are fancy tools that traders use to analyze the chart. Think of them as your secret weapons for predicting future price movements. Common indicators include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

These components work together to give you a complete picture of the market. It’s not just about the price; it’s about understanding the context behind those movements. And trust me, once you get the hang of it, reading a QQQ stock price chart becomes second nature.

How to Read a QQQ Stock Price Chart

Alright, now that you know what a QQQ stock price chart is and what it contains, let’s talk about how to read it. This is where the fun begins. Reading a chart isn’t as complicated as it sounds, but it does require a bit of practice. Here are some tips to get you started:

Step 1: Identify Trends

Trends are your best friends when it comes to analyzing a QQQ stock price chart. A trend is simply the general direction in which the price is moving. There are three main types of trends:

Read also:Eric Claptons Son Dead The Tragic Story Behind The Heartbreaking Loss

- Uptrend: This is when the price keeps hitting higher highs and higher lows. It’s like a staircase going up.

- Downtrend: The opposite of an uptrend, where the price keeps hitting lower lows and lower highs. Think of it as a staircase going down.

- Sideways Trend: Sometimes, the price doesn’t move in a clear direction. Instead, it moves within a certain range. This is called a sideways trend.

Identifying trends is crucial because it gives you an idea of what the market is doing. Are investors optimistic, or are they running for the hills? The trend will tell you.

Step 2: Look for Support and Resistance Levels

Support and resistance levels are like invisible barriers on the chart. Support is the level where the price tends to stop falling, and resistance is the level where the price tends to stop rising. These levels are important because they can indicate potential turning points in the market.

For example, if the QQQ stock price chart shows that the price has been bouncing off a certain support level, it might be a good time to buy. Conversely, if the price keeps hitting a resistance level and failing to break through, it might be a sign to sell.

Step 3: Use Technical Indicators

Technical indicators are like superpowers for chart readers. They help you analyze the chart in ways that aren’t immediately obvious. Here are a few popular indicators:

- Moving Averages: These smooth out price data to form a trend-following indicator. A common strategy is to look for crossovers between short-term and long-term moving averages.

- RSI (Relative Strength Index): This measures the speed and change of price movements. It can help you identify overbought or oversold conditions in the market.

- MACD (Moving Average Convergence Divergence): This indicator shows the relationship between two moving averages of the price. Traders often use it to spot potential buy or sell signals.

These indicators aren’t foolproof, but they can give you valuable insights into the market. Just remember, no single indicator is a crystal ball. It’s all about combining different tools to get a complete picture.

Factors Influencing QQQ Stock Price Chart Movements

Now that you know how to read a QQQ stock price chart, let’s talk about what makes it move. The stock market isn’t just a random rollercoaster; there are real factors that influence price movements. Here are some of the key factors:

1. Economic Indicators

Economic indicators are like the weather forecast for the economy. They include things like GDP growth, unemployment rates, and inflation. When the economy is doing well, investors tend to be more optimistic, which can drive up the QQQ stock price. Conversely, if the economy is struggling, the chart might take a hit.

2. Corporate Earnings

Corporate earnings are a big deal, especially for the companies that make up the Nasdaq-100. When these companies report strong earnings, it can boost the QQQ stock price. On the flip side, disappointing earnings can send the chart tumbling. Keep an eye on earnings season, which happens quarterly, to stay ahead of the curve.

3. Global Events

Global events can have a significant impact on the QQQ stock price chart. Whether it’s a geopolitical conflict, a natural disaster, or even a global pandemic, these events can create uncertainty in the market. And when investors get nervous, you can bet the chart will reflect it.

Long-Term vs. Short-Term Analysis

When it comes to analyzing the QQQ stock price chart, there are two main approaches: long-term and short-term analysis. Each has its own advantages and disadvantages, so it’s important to understand the differences.

Long-Term Analysis

Long-term analysis is all about the big picture. It looks at trends and patterns over months or even years. This approach is great for investors who are in it for the long haul. By focusing on the broader trends, you can avoid getting caught up in short-term market noise.

Short-Term Analysis

Short-term analysis, on the other hand, is all about timing. It looks at price movements over days or weeks. This approach is ideal for traders who want to capitalize on quick market moves. However, it requires a lot of attention and can be more risky.

Ultimately, the choice between long-term and short-term analysis depends on your investment goals and risk tolerance. There’s no right or wrong answer; it’s all about finding what works best for you.

QQQ Stock Price Chart Patterns to Watch For

Charts aren’t just random squiggly lines; they often form patterns that can give you valuable insights. Here are some common patterns you might see on a QQQ stock price chart:

1. Head and Shoulders

The head and shoulders pattern is one of the most well-known chart patterns. It consists of three peaks, with the middle peak (the head) being the highest. This pattern is often seen as a reversal signal, meaning the trend might be about to change.

2. Double Top and Double Bottom

A double top occurs when the price hits a certain level twice and then fails to break through. Similarly, a double bottom happens when the price hits a low point twice and then bounces back. These patterns can indicate potential turning points in the market.

3. Triangle Patterns

Triangle patterns occur when the price moves within a narrowing range, forming a triangle shape on the chart. These patterns can be continuation patterns, meaning they confirm the existing trend, or reversal patterns, meaning they signal a change in direction.

These patterns aren’t foolproof, but they can give you a heads-up about what might happen next. Just remember, no pattern is a guarantee, so always use them in conjunction with other tools.

QQQ Stock Price Chart vs. Other ETFs

Now that you’re a QQQ stock price chart expert, let’s compare it to other ETFs. While the QQQ ETF is one of the most popular, there are plenty of other ETFs out there. Here are a few key differences:

1. SPY (S&P 500 ETF)

The SPY ETF tracks the S&P 500 Index, which includes 500 of the largest companies in the U.S. Unlike the QQQ, which is heavily weighted toward tech stocks, the SPY offers broader exposure to the market. This makes it a good option for investors who want diversification.

2. DIA (Dow Jones ETF)

The DIA ETF tracks the Dow Jones Industrial Average, which includes 30 of the largest and most well-known companies in the U.S. The DIA is more focused on blue-chip stocks, which tend to be more stable than the tech-heavy QQQ.

3. IWM (Russell 2000 ETF)

The IWM ETF tracks the Russell 2000 Index, which includes small-cap companies. This ETF offers exposure to smaller, more growth-oriented companies, which can be more volatile than the QQQ.

Each ETF has its own strengths and weaknesses, so it’s important to choose the one that aligns with your investment goals. The QQQ stock price chart might be your go-to, but don’t be afraid to explore other options.

Strategies for Maximizing Returns with QQQ Stock Price Chart

Now that you know how to read a QQQ stock price chart and understand the factors that influence it, let’s talk about strategies for maximizing your returns. Here are a few tips:

1. Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the price. This helps you avoid the temptation to try and time the market, which can be risky. By investing consistently, you can take advantage of price fluctuations over time.

2. Technical Analysis

Technical analysis involves using charts and indicators to predict future price movements. While it’s not foolproof, it can give you valuable insights into the market. Just remember, no single indicator is a crystal ball. It’s all about combining different tools to get a complete picture.

3. Diversification